MID-SHIP Fertilizer – April 7, 2025

April 7, 2025

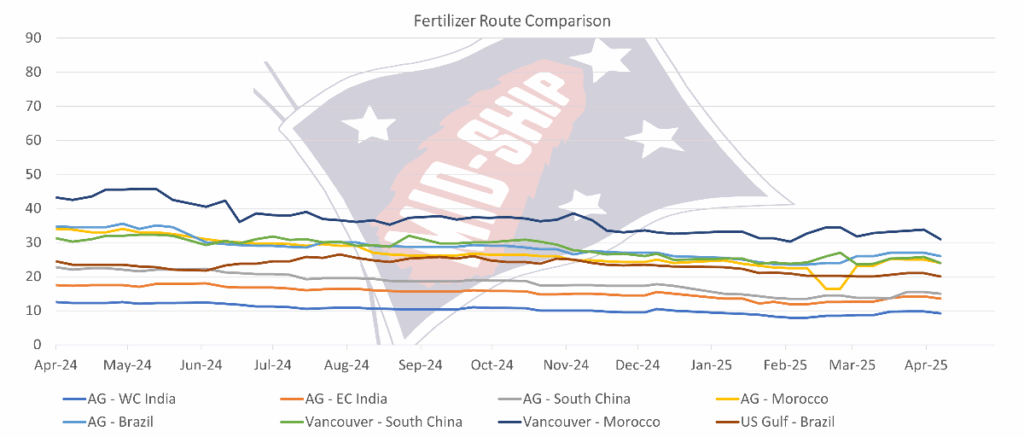

Market Overview:

There was a continuation of post-Liberation Day market trauma, with stock markets starting the week in a tailspin and commodity prices reacting to the changes brought about by U.S. tariffs and countermeasures, particularly China’s. We start the week as we ended last week: a sea of red.

Last week, sentiment in the paper markets (FFAs) significantly pulled back, coupled with a meaningful drop in fuel prices. Eight OPEC+ countries unexpectedly agreed to increase output in May by 411,000 b/d, rather than the previous plan of 135,000 b/d, as part of its plan to gradually unwind previous production cuts. Goldman Sachs cut its estimate for Brent crude’s average price in 2025 by 5.5% to $69 per bbl, citing higher OPEC+ supply and a global trade war weighing on oil demand.

Capes were down to end last week and continue soft to start the new week. Panamax, Supra, and Handy Size continue to be softer, trading in a narrow range to the end of the week/start of the new week.

Subscribe below to receive the full report.