MID-SHIP Petcoke Report – Dec 4, 2024

December 4, 2024

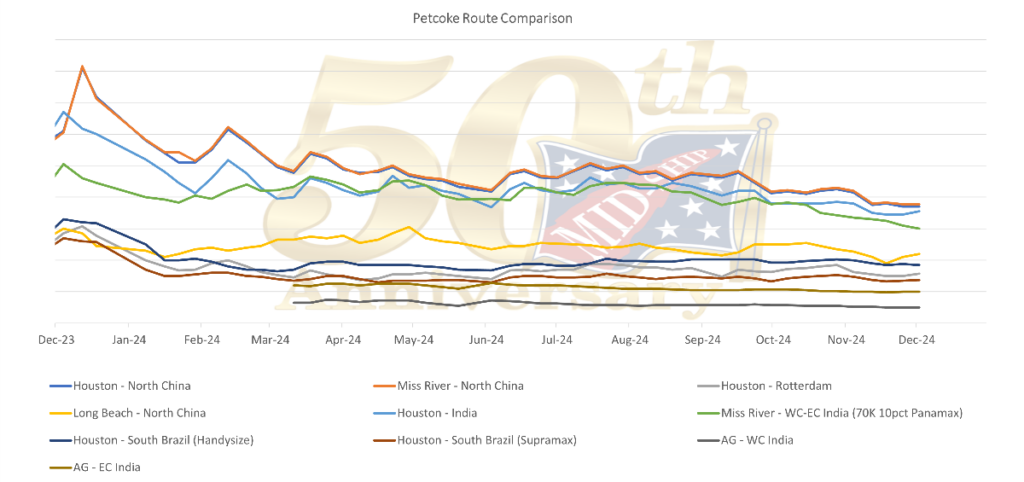

Market overview:

Last week, the dry bulk market continued to decline as it closed the week with the Baltic Exchange’s key index dropping to a three-week low as rates declined across the larger sizes. Most significantly, the Cape size market took a hit as it dropped nearly 25% w-o-w, marking its lowest levels since early November. This downturn unfolded amid volatile iron ore futures, which saw fluctuations despite positive trading activity on China’s Dalian Commodity Exchange. This is largely in part due to the market bracing for impact as President-elect Trump has threatened to enforce tariffs more than 60% on all Chinese-exported products.

The Panamax segment extended its downward trajectory, ending the week with its tenth consecutive decline and reaching its lowest levels in over a year. Relative to the Cape size, smaller vessel categories decreased marginally, with both the Supramax and Handysize Indices falling only 1%, remaining relatively stable at the previous month’s levels.

The Supra/Ultramax market in the Pacific experienced a slight uptick especially in the NOPAC prior to Thanksgiving holidays. Optimism persists as adverse weather and ships delaying are expected to tighten availability moving into December. In the Atlantic, rates declined as vessel supply continued to exceed demand, though T/A levels showed a modest w-o-w improvement. Handysize rates in the Pacific remained steady, supported by strong competition for Australian grain shipments and the emergence of forward steel cargoes. Meanwhile, Atlantic rates held firm, reflecting consistent cargo flow throughout the week. In the US Gulf, both Ultramax and Handysize markets saw a flurry of pre-Thanksgiving activity as owners and charterers rushed to secure fixtures. Ultramax T/A and FH routes remained in the high teens, with rate stability anticipated heading into December. The USG Handy market also saw an early-week spike in activity, but rates stayed flat, with over 40 vessels set to open in the USG, NCSA, and USEC over the next three weeks.

Ship recycling activity remains subdued due to several factors, including fluctuating steel prices and unfavorable economic conditions in key recycling markets like South Asia and Turkey. India, historically a dominant player in ship recycling, has faced reduced demand due to declining steel plate prices and currency depreciation. Similarly, Pakistan’s market has been constrained by limited foreign reserves and restrictive financial policies, while Turkey has also seen a slowdown in activity, partly due to lower tonnage availability and economic pressures. Despite these challenges, some stability has recently been observed in steel prices, which may encourage marginal recovery in recycling activity moving forward.

Subscribe below to receive the full report.