MID-SHIP Fertilizer – Jan 7, 2024

January 7, 2025

Market Overview:

An expected slow start to the week as market participants return to the office after an extended holiday break and today’s Epiphany holiday.

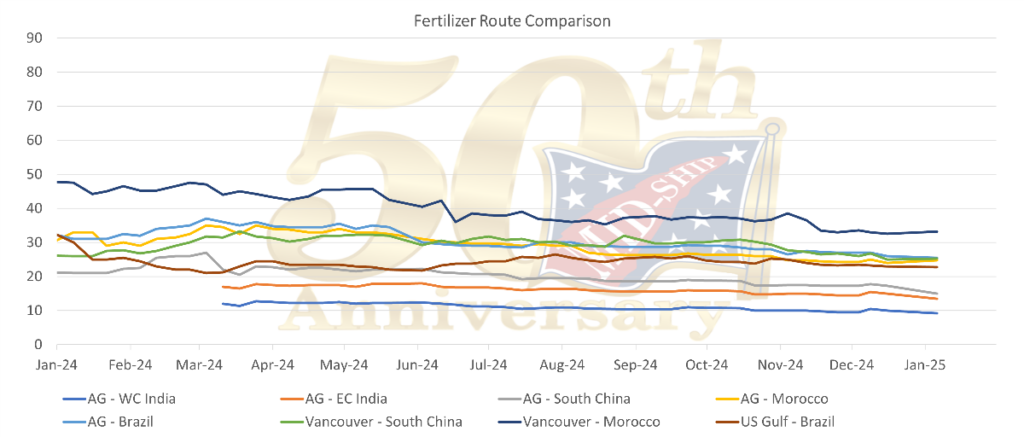

Our market showed some small signs of life during the break; remaining shipments and vessel delays necessitated some spot-fixing. The downward trend and narrow-range trade continued as we started the new year.

A combination of factors is contributing to the malaise in dry bulk rates in Q4, beyond ongoing China real estate markets/local government debt concerns and current seasonal preholiday lull. The contributing factors are fundamental in nature: normalized Panama Canal transits returning capacity to the market this year, a steady increase in new build vessel arrivals (predominately geared vessels), better port efficiency, and less port congestion generally (noteworthy, in Brazil, less corn demand from China. A double knock-on effect of less congestion and fewer long haul grain stems); intra segment cannibalization of rates (Panamax competing with Capes and in some cases Panamax infiltrating non-traditional commodity markets) – more broadly it’s been about “effective fleet growth.” The rerouting of vessels away from the Suez Canal remains a supportive factor.

Looking forward, after quietly moving through the Christmas and New Year holiday lull, we expect a likely quiet January leading up to the January 29th Chinese Lunar New Year celebration and the largest annual human migration in the world. Then, things start to come back to life in March as the grain trade shifts to the southern hemisphere.

The future developments rely on the impact of recent stimulus in China and the uncertainty of new U.S. administration’s impact on trade, global economics, and geopolitical relations. We expect stability on the demand side in the coming year, save impact of potential sanctions on steel parcel trade and Agri. Considering the fundamental changes on the supply side, we anticipate similar levels on average and increased positional volatility in 2025 due to the more finely balanced supply/demand ratio of our dry bulk market.

Subscribe below to receive the full report.