MID-SHIP Report: Dry Bulk Freight Market – June 5 2025

June 5, 2025

Fundamentally, the market remains consistent with early 2025 conditions, characterized by a mature commodity cycle and potentially reduced volumes of both major and minor bulks, uncertainty due to geopolitical risk (Russia-Ukraine, Gaza, India-Pakistan), and the U.S. government’s global trade negotiations. The vessel fleet continues to grow moderately.

The largest vessels are enjoying a favorable supply-demand balance in 2025. The Cape size fleet growth is projected to be minimal this year, while ton-mile demand growth is expected to be above 3%. The Baltic Dry Index (BDI) and Cape size-specific indices are expected to remain volatile, with stronger performance in Q3 due to seasonal commodity demand but potential softening in Q4 if economic headwinds intensify. Projects like Guinea’s Simandou and West Australia’s Onslow enhance long-haul trade prospects. The benchmark route from Brazil to China is reported at over $24.00 per ton and heading north, as compared to $18.20 this time last month.

The Panamax market has been under pressure during the month of May, declining from $12,400 to $10,000 on average in the month. Fortunately, at least now, perhaps on a tailwind from the firm Cape market, but more likely strong demand for grain shipments originating in the Atlantic, both trans-Atlantic and Front Haul, and a pick-up in USEC to India Coal trades. China’s slowing demand has been driving Panamax rates in the Pacific down by 50% since April when prospects within the basin were significantly brighter. Now, Panamax is at parity in both basins.

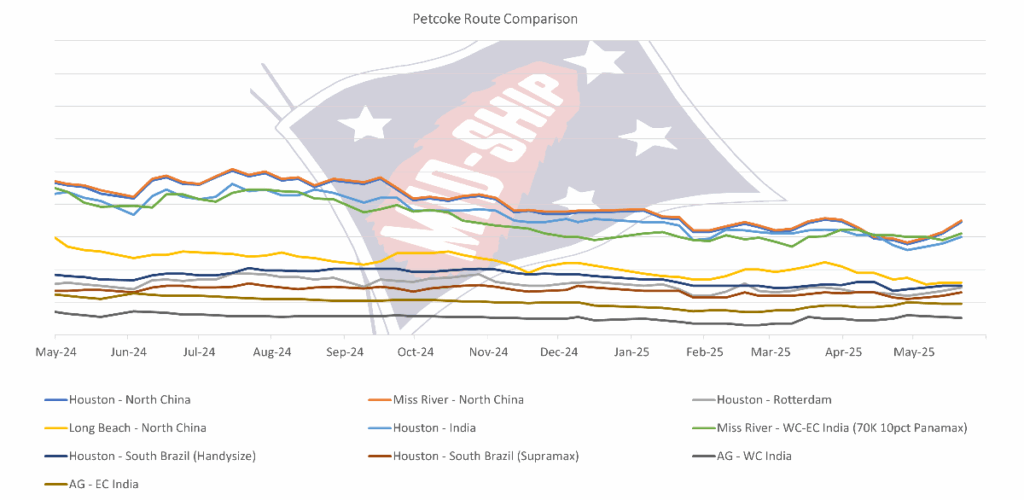

The Supramax/Ultramax segment of the market has entered a more subdued phase after a previously bullish stretch. The U.S. Gulf, which had been a bright spot with Trans-Atlantic and petcoke runs commanding robust returns, is now showing signs of cooling. A growing number of open ships and a narrowing spread of viable cargoes are beginning to weigh on rates. Early June optimism has given way to a more measured outlook, with forward sentiment pointing to a softer second half of the month. A widening gap between vessel supply and cargo demand is becoming increasingly apparent in the Asia-Pacific region. While North Pacific rounds have held steady, Southeast Asia continues to lag behind expectations. Indonesian coal exports remain subdued as China’s push to stockpile more domestic coal while curbing imports has affected demand and added pressure to rates.

Since our previous report, the Handy size dry bulk market has remained subdued across both the Atlantic and Pacific basins, with limited fresh inquiries and an oversupply of prompt tonnage. While select submarkets have experienced modest gains, overall activity has been restrained. The positive momentum highlighted two weeks ago has persisted, with the U.S. Gulf maintaining its strength. The South Atlantic market has remained steady to firm, underpinned by balanced supply and demand dynamics. Activity in the Continent has been curtailed by national holidays. The Pacific market has held steady, though sentiment is softening due to a growing buildup of vessels in key loading areas. The North Pacific (NOPAC) saw increased activity this week, with rates edging slightly higher.

The ongoing Russia–Ukraine conflict heavily influences developments in the Black Sea basin. While diplomatic narratives suggest the possibility of renewed negotiations, there is little evidence of de-escalation. The continued military activity disrupts local logistics and casts a long shadow over trade routes stretching from the Black Sea to the Baltic. This geopolitical instability remains the most significant wildcard capable of altering the market’s direction, especially for bulk cargoes and regional shipments. Historically, the June-to-September period is marked by lower activity levels, particularly in the Mediterranean, Black Sea, and Baltic regions. Barring any major geopolitical shocks or sudden shifts in macroeconomic conditions, the remainder of the summer is expected to follow the same trajectory. Market sentiment is likely to remain cautious, with many stakeholders positioning themselves for a more active fourth quarter.

The Indian Ocean dry bulk market saw a shift toward softening this week, particularly in the Ultramax segment, as oversupply and seasonal slowdowns weighed on sentiment. Handysize vessels remained relatively tight, though activity was thinner overall due to holidays and weaker cargo flows. PG-WCI remained bearish amid a growing tonnage list and limited fresh demand. Eid holidays have delayed some Bangladeshi shipments, further reducing activity, and exports cooled in WCI as the monsoon season approaches. The growing tonnage list will likely put further pressure on rates in the near term.

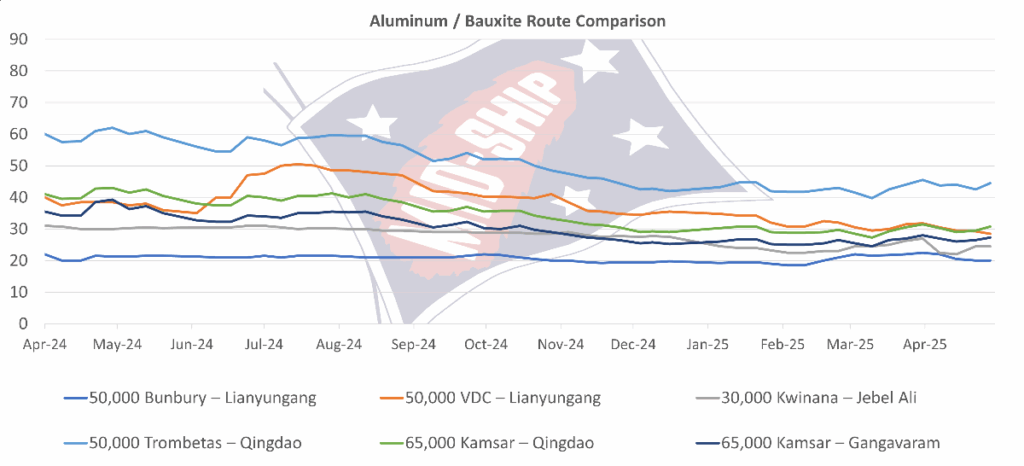

In the Australia and New Zealand region, the Handysize and Supramax markets are showing signs of moderate stability. This is underpinned by global supply-demand dynamics as well as local seasonal trade flows. Of particular note is the traditional end-of-financial-year cargo push from Australia, where shippers typically aim to finalize and load outbound parcels by late June. This has contributed to a short-term uptick in demand, particularly for mid-June positions. Handysize vessels in the region continue to be employed across a range of commodities, including grain, logs, sugar, salt, and minor bulks. Supramax vessels remain critical for heavier export trades such as coal and bauxite. Utilization levels for both vessel classes remain healthy, reflecting consistent demand across these core segments.

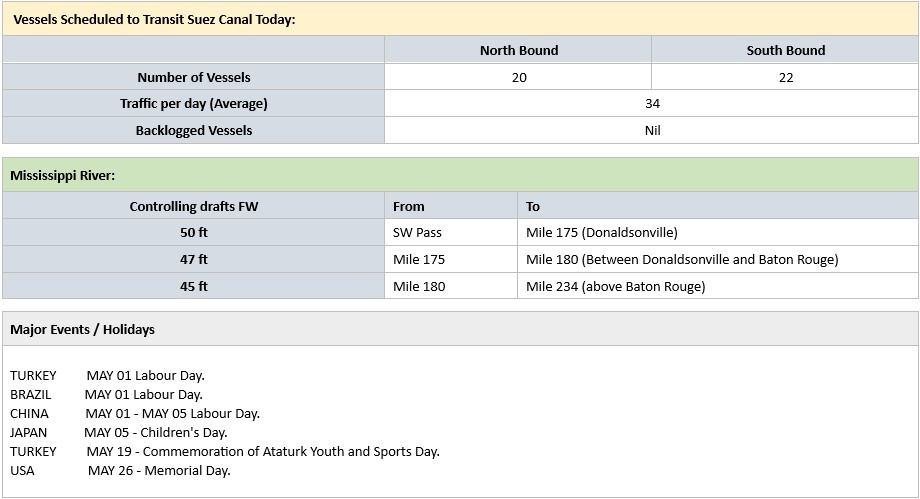

In the inland market in North America, recent high-water events and lock closures across the Mississippi River system have driven heavy delays in fleets from New Orleans to Chicago. Horsepower and tow size reductions have created a backlog that is taking up to 10 days to process for barge lines.

Expect delays over the following weeks as lanes are cleared out. Bridges on the LMR are daylight only and some require assist boats. The Atlantic hurricane season is upon us, starting on June 1st and closing on November 30th. Roughly 13-19 named storms are forecasted this year, with 3-5 of them being ‘major’ hurricanes above category 3. There is a 51% chance of a major storm making landfall in the U.S. this year. The USDA reported grain barge freight for St. Louis to NOLA was trading 315.94% of tariff as of the week ending May 27th, 2025. For the week ending May 24th, barged grain movements totaled 734,650 tons. This was 17% less than the previous week and 34% more than the same period last year.

Looking ahead, forward freight agreement (FFA) markets are showing Handies down and Supras stable compared to two weeks ago. Q3 and Q4 2025 contracts for Handies are trading down at just above 4% for both compared to spot levels. Supras for the same periods are slightly firmer, trading at a premium of 3.0% and 2.6%, respectively.

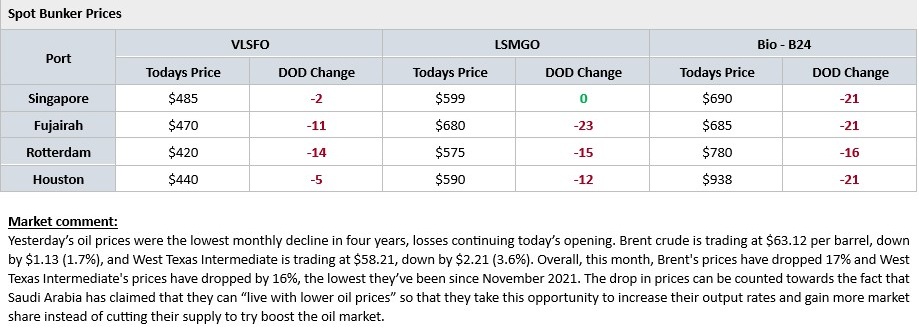

In bunker markets, Very Low Sulphur Fuel Oil (VLSFO) in Singapore is currently trading at about USD 500 per metric ton — down about USD 20/25 from two weeks ago.

Subscribe below to receive the full report.