March 26, 2025

The Capesize market is subject to demand from China as one of its main drivers, this month’s announcement of capacity cuts at steel mills challenges earlier forecasts of flat ore demand in 2025. Of late, Iron ore miners have had a low level of prompt inquiry in recent weeks, and rates have declined recently as evidenced by the 182,000 deadweight vessel front hauls declining from a recent peak of $47,900 per day to today’s level of $45,700 route.

Despite the worldwide geopolitical and economic turmoil, the Panamax time charter average rose by 3,500 USD per day over the last two weeks. The Pacific basin is still in the driver’s seat, with levels increasing by 50% since the beginning of March; Indonesia and Australian exports are the main driving forces, combined with the North Pacific grain exports. The short-period market is gaining momentum with vessels fixing in excess of 16,000 per day for a four to six-month period in the Pacific while the one-year is stacked in the $14,000 per day level.

In the Supramax market, the USG remains flat as fresh cargoes are met with increased availability of non-chinese tonnage being released in the market after the hearings this week. Having now more information of the potential timeline has resulted in many Owners/Operators increasingly convinced that these strict measures will not be implemented any time soon and potentially not until Q3, while others remain very cautious and reluctant to conclude any business without a clause that gives them some coverage if the worst were to happen.

In the US Gulf, the handysize market remained stable. The US East Coast is getting tighter on available prompt tonnage, which could boost rates. South Atlantic activity has seen larger Handy’s commanding a premium. The Continent has been a stronger market. In the Mediterranean region, sentiment has been positive with news of the Turkish import quota pushing up to 1 million tons of corn. On the Pacific side, SE Asia is seeing an imbalance of too many ships in the area and limited cargo.

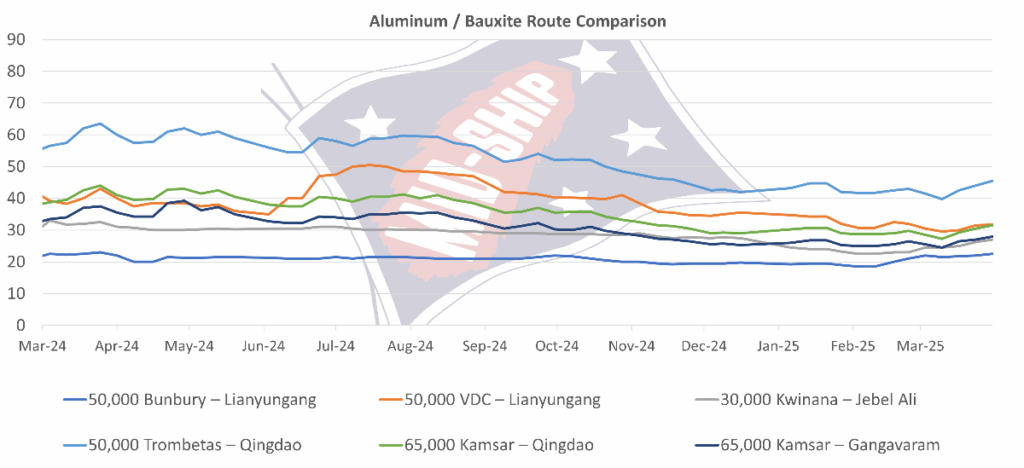

In the Brazilian dry bulk freight market, we have seen significant improvement in recent weeks. With the surge in demand, particularly for Capesize vessels, shipping rates for Brazilian routes have increased substantially. The daily time charter equivalent (TCE) for Capesize ships carrying cargo from Brazil to China rose dramatically, from $7,000 per day in February to almost $26,000 a day this month, this uptick is driven by strong export volumes for commodities like iron ore and bauxite, as well as the ongoing recovery of Chinese import activity.

Rates in the Med/Black Sea continue to rise, further fueled by this week’s news that Russia and Ukraine have agreed to a ceasefire in the Black Sea, following US-led talks in Riyadh.

Coastwise freight rates in the Northern European and Mediterranean markets have remained stable this week, reflecting a balance between supply and demand dynamics. The European Union’s impending changes to its steel safeguard measures, set to take effect on April 1st, are anticipated to cause an immediate reduction in steel imports. Reduced steel imports will likely translate into lower demand for shipping capacity, putting downward pressure on freight rates. The potential for a ceasefire between Russia and Ukraine remains a pivotal factor influencing global trade and freight markets. A ceasefire could lead to the reopening of key trade routes in the Black Sea and improve overall market stability.

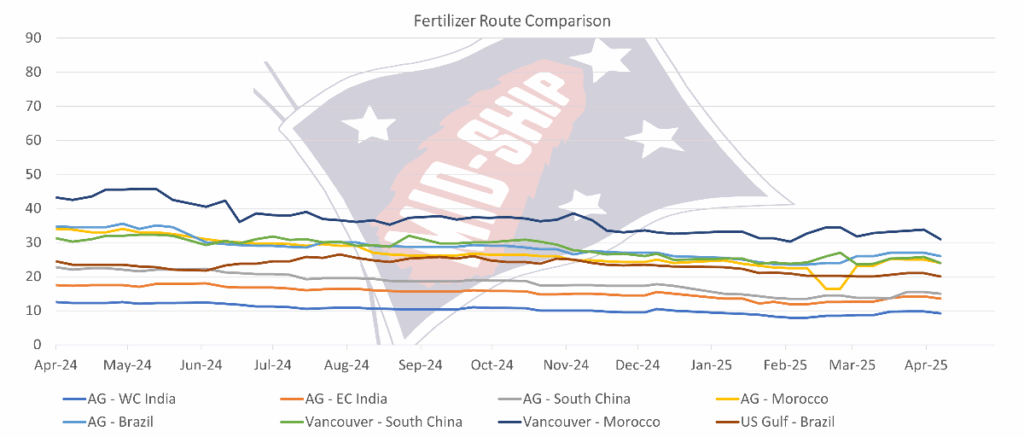

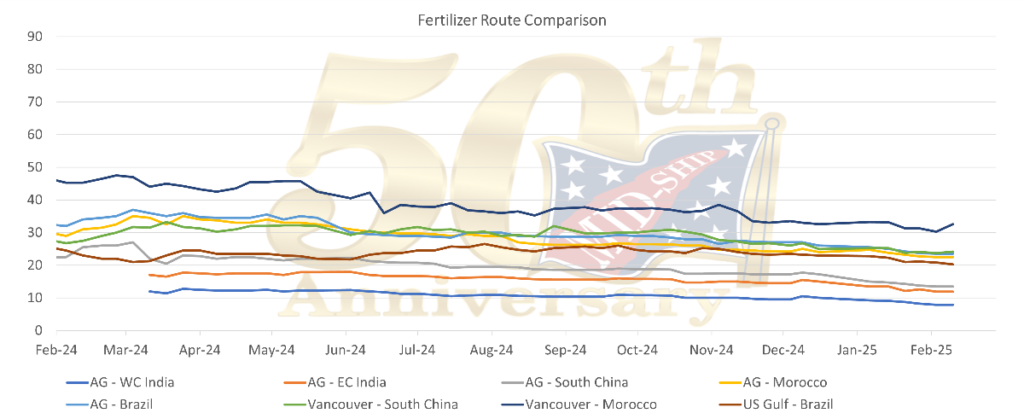

Market dynamics in the Middle East region have remained largely unchanged since our previous update. Despite the ongoing observance of the Holy Month of Ramadan across much of the region, notable shipping activity has persisted, particularly from West Coast (WC) India. Over the past week, several backhaul fertilizer cargoes from the Arabian Gulf (AG) have been observed, alongside shipments of salt and iron ore from WC India to China.

In the South Pacific, time charter levels for both handies and ultras have continued their rise over the last two weeks. The Baltic handy index route Southeast Asia to Japan—Singapore trip is quoted at around USD 11,000, up around USD 1,500 over the last two weeks. The ultra index route North China / Aussie round voyage has followed the trend with the handies and is trading around USD 14,225, up around USD 1,800 per day compared to two weeks ago.

Futures for Q2 2025 for both handies and supras are trading more in line with spot now at a premium of about 6-7%. Handies for Q3 2025 are trading at about 6% premium to the current spot levels while supras are selling up at around 8% to spot levels. Sentiment is that the market correction we have seen over the last month is about to slide sideways for a bit.

Subscribe below to receive the full report.