Tag: midship

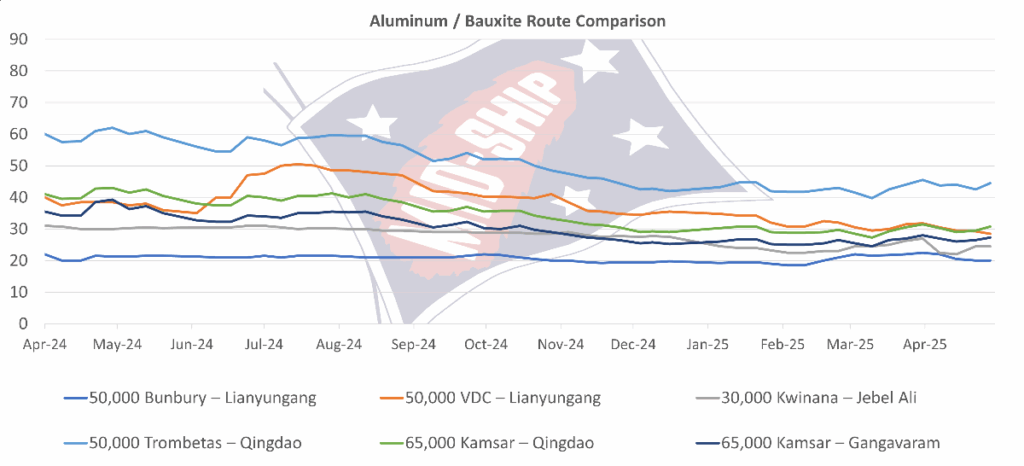

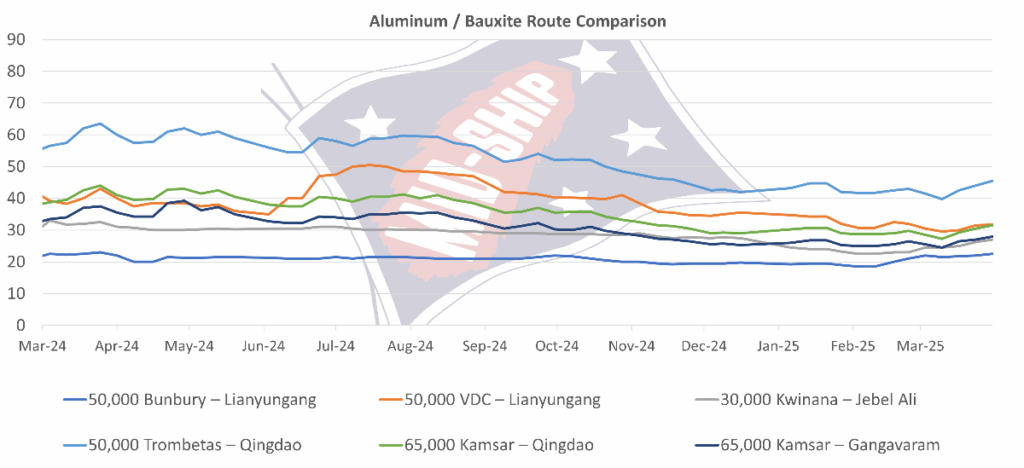

MID-SHIP Alumina/Bauxite – April 28, 2025

April 28, 2025

Market Overview:

The week began slowly but positively, with the Geneva Dry Conference and the upcoming Mayday holidays on Thursday expected to cause some disruption.

Uncertainty around U.S. trade policy and its impact on the global economy continues to drive the daily discourse and stunt activity in the U.S. Gulf. Several vessel Owners are commenting about having written off the U.S. Gulf through May.

Capes started positively, with growing demand within the Atlantic. Panamax moved sideways but remains firm after several weeks of improved rates, particularly EC South America. Supra, like Panamax, moves sideways with a firm undertone. Handy size remains static and lackluster.

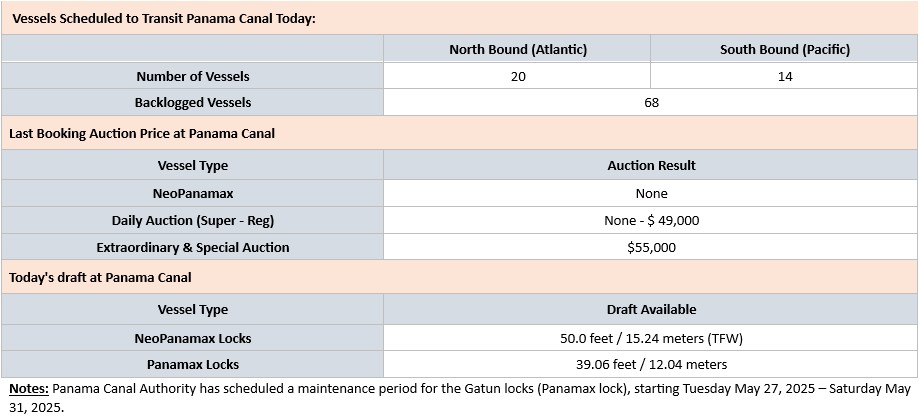

Domestically, historic flooding on the Ohio River will drive delays along the Lower Mississippi as the water volume moves down the system. Expect high water delays, restrictions, and closures over the next several weeks.

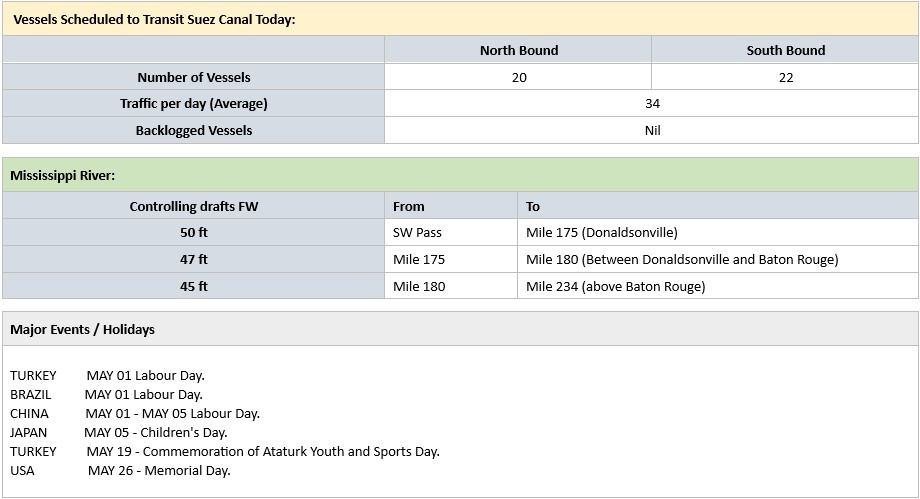

Internationally, we are a few weeks away from the commencement of the Monsoon Season in West Coast India. The EU’s electronic security screening system (ICS2 Release 3) for ocean, road, and rail freight, implemented on April 1, 2025, adds compliance burdens, potentially slowing customs processes. The full impact of ICS2 Release 3 will become clearer in May, with possible delays at European ports as shippers and carriers adjust to new requirements. Companies should ensure compliance to avoid bottlenecks.

Subscribe below to receive the full report.

MID-SHIP Report: Dry Bulk Freight Market – April 23, 2025

April 23, 2025

Following the Easter break, naturally, it was a slower start to this week.

We maintain our position of a recovery in freight rates for Cape-size vessels in the balance of the year, but rates will likely remain below 2024 levels. There is no escaping the early-year drag on what were already expected to be lower numbers overall year on year. Grain, Iron Ore, and Coal were all down. Weak Chinese import demand is the key factor for the market’s largest vessels. In Q1, Chinese import demand in ton-mile terms fell in comparison to Q4 2024 and Q1 2025, and Q1 2024 vs. Q1 2025. Bauxite continued to be a bright spot, growing substantially year over year in the same Q1 period.

Panamax freight rates have shown a broad-based increase. The Time Charter Average, which reached a low of $10,500 a little more than ten days ago, is now steadily climbing toward $12,000 per day – a significantly robust level as compared to the $6,800 levels at the start of the year despite ongoing global trade uncertainties stemming from two major conflicts and the U.S.-China tariff dispute.

The Supramax market continues to show strong regional contrasts. Asia remains strong with steady coal demand, while the Atlantic is slow and needs a boost. The Baltic Supramax Index rose to 964 points on April 23, 2025 – its highest level in weeks – driven primarily by robust activity in Asia, supported by steady demand for Indonesian Coal and nickel ore shipments. Softening Indian iron ore exports due to domestic urbanization efforts and reduced Chinese demand are beginning to weigh on rates.

The handy market was also still slowing coming back from the Easter holidays. In the U.S. Gulf, the market has been trending sideways, and the supply and demand have been fairly balanced. However, more ships are starting to be open spot, and owners have been doing the chasing for cargo interest. In the South Atlantic, the Handy market remains quite active, with the indexes showing more green for this week. Brazilian agricultural exports, particularly soybeans and corn, continue to provide a steady flow of cargo. Regions like the Continent and the Mediterranean have failed to gain momentum. Lack of fresh cargo and larger lists of available ships have decreased the rate from the last fixed. The Pacific Basin has seen more activity in both the North and the South hemispheres.

Despite a general softening in global bulk carrier rates this week, the South Atlantic remains one of the few active regions showing week-on-week gains. This uptick is largely driven by Brazilian and Argentinian farmers capitalizing on the open Chinese market, as U.S. soybean and agricultural exports remain largely halted due to the ongoing U.S.-China tariff dispute. Meanwhile, uncertainty surrounding U.S. trade policy continues to weigh on broader market sentiment.

Despite the Easter Monday holiday to start the week, we continue to see activity across the Indian Ocean region, especially BH sulphur shipments from AG, gypsum and aggregates from AG to EC India, and salt from WC India to China. In terms of market dynamics, particularly between AG–WC India range, the list of available spot vessels has continued to decline, with most owners’ preference for front haul business rather than back haul business due to continued uncertainty in the U.S. markets.

The USDA reported grain barge freight for St. Louis to NOLA was trading 397% of tariff as of the week ending April 15, 2025. For the week ending April 12, 2025, barged grain movements totaled 562,400 tons. This was 53% more than the previous week and 13% more than the same period last year.

The dry bulk market is projected to weaken in 2025 due to supply growth (2–3%) outpacing demand (falling 0.5–1.5% in BIMCO’s base scenario). Cape-size vessels may fare better due to lower fleet growth and steady iron ore demand, while Panamax and Supramax face pressure from high deliveries and weak coal/grain shipments.

Subscribe below to receive the full report.

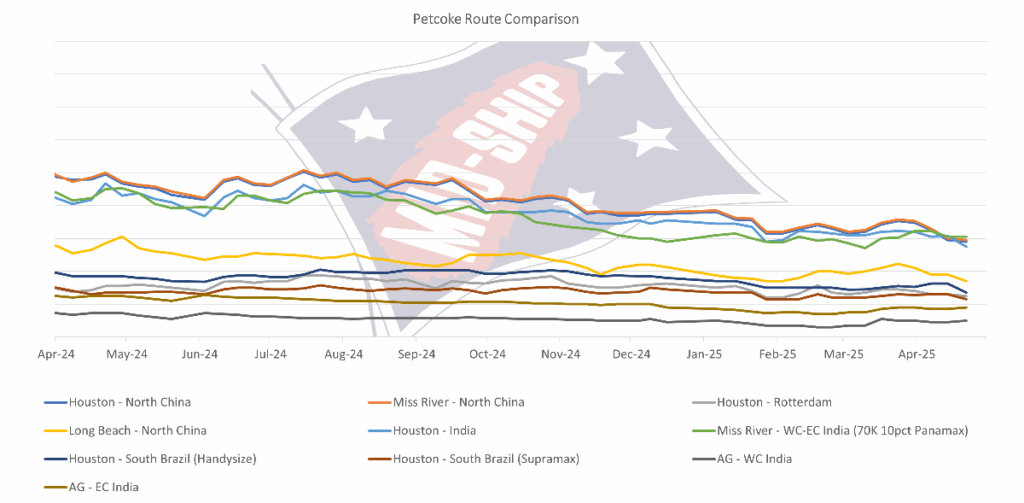

MID-SHIP Petcoke Report – April 22, 2025

April 22, 2025

Market overview:

Uncertainty around U.S. trade policy and its impact on the global economy has stunted activity.

On April 17, 2025, the U.S.T.R. Section 301 Maritime Action against Chinese dominance in the maritime sector announced the implementation of fees on Chinese-owned/operated vessels and Chinese-built ships starting in October 2025. The U.S.T.R.’s determination consists of four immediately implemented actions (Annexes I-IV) and one proposed action subject to public comment (Annex V). These actions include fees on Chinese vessel operators and owners, fees on Chinese-built vessels, fees on foreign-built vehicle carriers, restrictions on LNG transport, and proposed tariffs on port equipment. Please see our special bulletin for more information and details. Important takeaways are that ships smaller than 4,000 TEU and 55,000 DWT in capacity are exempt from the port fees for Chinese-built vessels, which provides relief for the container ship trade between Miami and the Caribbean and others that rely on smaller tonnage. Additionally, bulk ships with a capacity of up to 80,000 DWT are spared. That should free bulkers and tankers of up to Panamax in size.

There are exceptions for Chinese-built ships on routes of less than 2,000 nautical miles. In addition to providing relief for the Caribbean market, the exemption responds to the concerns of Canadian vessel operators, those trading in the Great Lakes-Saint Lawrence Seaway shipping corridor. Vessels identified as lakers and vessels arriving in Ballast (empty) are exempted.

Subscribe below to receive the full report.

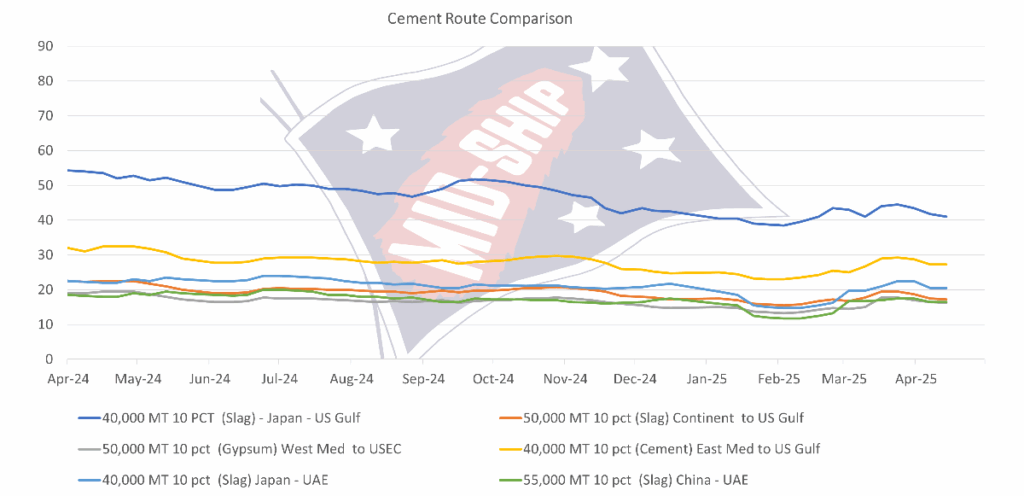

MID-SHIP Cement Report – April 14, 2025

April 14, 2025

Market Overview:

A very slow start to the new week due to the Passover and Easter holidays this week.

Trump “world” continues to distract and disrupt our markets, as well as both the stock and bond markets, on top of geopolitical events: War in Ukraine, Middle East conflict(s), Houthis – Red Sea, AND The USTR Executive Order related to the Section 301 investigation and restoring America’s Maritime Dominance.

Container shipments from China’s two largest container terminals in Shanghai and Shenzhen are reported to have been halted, and no further shipments to the USA before the April 9 Tariff deadline.

Factory production is said to have all but stopped at major hubs as the trade war between the U.S. and China continues. China has also ordered its airlines not to take any further deliveries of Boeing Co. jets and carriers to halt purchases of aircraft-related equipment and parts from U.S. companies as part of the escalating contest.

Capes were down to the end last week and showing a little promise to start the new week. Panamax and Supra appear to have flattened out, which is good news, and Handy sizes seem to have missed the memo that we have started the seasonally higher second-quarter trading in a narrow range to the end of the week/start of the new week.

Subscribe below to receive the full report.

MID-SHIP Report: Dry Bulk Freight Market – April 9, 2025

April 9, 2025

The Cape market has had a rough ride recently, with China fundamentals impacting demand and lowering daily rates. Interestingly, despite the recent declines, the Cape market time charter average today stands at $14,900+, up about 30% from the start of the year ($10,400 on January 2). Demonstrating the resilience of the Cape market due to strong supply-side fundamentals in 2025.

The Panamax sector is drifting south, preparing for the worst. Following the Worldwide tariff imposed by the U.S. Government, international seaborne activities have dramatically slowed down, and very few new trades, at least involving the United States, have been concluded, resulting in a slow but steady drop in freight levels. The Atlantic basin is taking the worst hit from a possible trade war; rates have dropped below the USD 10,000 per day support level, still far from the mid-March bottom at USD 5,000, but concerns are spreading rapidly. In the Pacific, daily time charter rates are trading at a significant premium compared to the Atlantic; South Africa, Indonesia, and Australia are picking up, but as more shipowners are trying to void the Atlantic Ocean, vessel counts in the Pacific are growing, which will eventually lead to a drop in freight.

The North Atlantic Supramax market remains highly positional, with significant downward pressure on rates. Vessel owners, traders, and charterers are grappling with the impacts of the USTR (U.S. Trade Representative) fees on Chinese vessels calling U.S. ports and the ongoing volatility of the Trump Tariff War of 2025. These geopolitical challenges create uncertainty in the market and a lack of clear direction for future trade. In the Pacific, the steel market ex-North Asia continues to yield premiums for shipments to the Continent, Mediterranean, and Persian Gulf regions.

The Handy market has not been able to gain any momentum as the shipping world awaits the details of the executive order signed by President Trump this week. Activity is minimal from the U.S. Atlantic and U.S. Gulf; rates have started to soften since the last fixed. The Baltic index is also not helping the negative sentiment, as the rates are dropping quicker than what is being done in the physical spot market. The U.S. Gulf to Europe Trans-Atlantic trip has been marked as below USD 11,000 per day, according to the index. However, owners will larger Handy have managed to fix this route in the USD 13,000 per day earlier in the week.

Subscribe below to receive the full report.

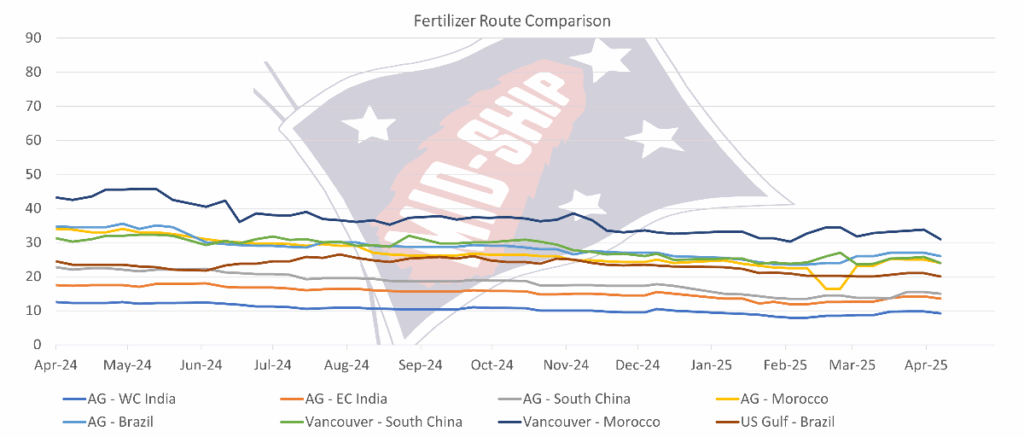

MID-SHIP Fertilizer – April 7, 2025

April 7, 2025

Market Overview:

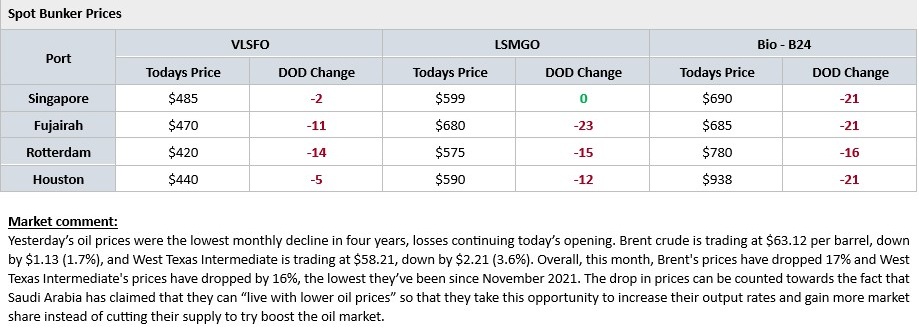

There was a continuation of post-Liberation Day market trauma, with stock markets starting the week in a tailspin and commodity prices reacting to the changes brought about by U.S. tariffs and countermeasures, particularly China’s. We start the week as we ended last week: a sea of red.

Last week, sentiment in the paper markets (FFAs) significantly pulled back, coupled with a meaningful drop in fuel prices. Eight OPEC+ countries unexpectedly agreed to increase output in May by 411,000 b/d, rather than the previous plan of 135,000 b/d, as part of its plan to gradually unwind previous production cuts. Goldman Sachs cut its estimate for Brent crude’s average price in 2025 by 5.5% to $69 per bbl, citing higher OPEC+ supply and a global trade war weighing on oil demand.

Capes were down to end last week and continue soft to start the new week. Panamax, Supra, and Handy Size continue to be softer, trading in a narrow range to the end of the week/start of the new week.

Subscribe below to receive the full report.

MID-SHIP Alumina/Bauxite – Mar 31, 2025

March 31, 2025

Market Overview:

While the dust is settling in the aftermath of last week’s U.S. Trade Representative hearing and pending final determination, on Wednesday this week, we await the declaration of reciprocal tariffs on all things by the U.S. Administration. The result has been muted business activity and positional volatility in the spot market, particularly in the U.S.-related trades.

While market sentiment has shown signs of picking up as we start the seasonally higher second quarter, Geopolitical events and economic news cloud the mind. Nevertheless, it’s about moderate fleet growth and likely softer year-over-year cargo volume growth in 2025.

The market opened the new week with flat sentiment across the four segments, which was reflected in the Baltic Indices. Capes were mostly down last week, and the trend looks to continue. The Pacific continues to outperform the Atlantic basin for Panamax, with the time charter average improving by about $1,000 per day overall. Supra traded in a narrow range and was down to the end of the past week.

The Eid al-Fitr (Hari Raya Aidilfitri) marks the end of Ramadan in 2025 based on the sighting of the crescent moon March 31/April 1 and was affecting trading in the Middle East and shipping hub Singapore to start this week.

Subscribe below to receive the full report.

MID-SHIP Report: Dry Bulk Freight Market – Mar 26, 2025

March 26, 2025

The Capesize market is subject to demand from China as one of its main drivers, this month’s announcement of capacity cuts at steel mills challenges earlier forecasts of flat ore demand in 2025. Of late, Iron ore miners have had a low level of prompt inquiry in recent weeks, and rates have declined recently as evidenced by the 182,000 deadweight vessel front hauls declining from a recent peak of $47,900 per day to today’s level of $45,700 route.

Despite the worldwide geopolitical and economic turmoil, the Panamax time charter average rose by 3,500 USD per day over the last two weeks. The Pacific basin is still in the driver’s seat, with levels increasing by 50% since the beginning of March; Indonesia and Australian exports are the main driving forces, combined with the North Pacific grain exports. The short-period market is gaining momentum with vessels fixing in excess of 16,000 per day for a four to six-month period in the Pacific while the one-year is stacked in the $14,000 per day level.

In the Supramax market, the USG remains flat as fresh cargoes are met with increased availability of non-chinese tonnage being released in the market after the hearings this week. Having now more information of the potential timeline has resulted in many Owners/Operators increasingly convinced that these strict measures will not be implemented any time soon and potentially not until Q3, while others remain very cautious and reluctant to conclude any business without a clause that gives them some coverage if the worst were to happen.

In the US Gulf, the handysize market remained stable. The US East Coast is getting tighter on available prompt tonnage, which could boost rates. South Atlantic activity has seen larger Handy’s commanding a premium. The Continent has been a stronger market. In the Mediterranean region, sentiment has been positive with news of the Turkish import quota pushing up to 1 million tons of corn. On the Pacific side, SE Asia is seeing an imbalance of too many ships in the area and limited cargo.

In the Brazilian dry bulk freight market, we have seen significant improvement in recent weeks. With the surge in demand, particularly for Capesize vessels, shipping rates for Brazilian routes have increased substantially. The daily time charter equivalent (TCE) for Capesize ships carrying cargo from Brazil to China rose dramatically, from $7,000 per day in February to almost $26,000 a day this month, this uptick is driven by strong export volumes for commodities like iron ore and bauxite, as well as the ongoing recovery of Chinese import activity.

Rates in the Med/Black Sea continue to rise, further fueled by this week’s news that Russia and Ukraine have agreed to a ceasefire in the Black Sea, following US-led talks in Riyadh.

Coastwise freight rates in the Northern European and Mediterranean markets have remained stable this week, reflecting a balance between supply and demand dynamics. The European Union’s impending changes to its steel safeguard measures, set to take effect on April 1st, are anticipated to cause an immediate reduction in steel imports. Reduced steel imports will likely translate into lower demand for shipping capacity, putting downward pressure on freight rates. The potential for a ceasefire between Russia and Ukraine remains a pivotal factor influencing global trade and freight markets. A ceasefire could lead to the reopening of key trade routes in the Black Sea and improve overall market stability.

Market dynamics in the Middle East region have remained largely unchanged since our previous update. Despite the ongoing observance of the Holy Month of Ramadan across much of the region, notable shipping activity has persisted, particularly from West Coast (WC) India. Over the past week, several backhaul fertilizer cargoes from the Arabian Gulf (AG) have been observed, alongside shipments of salt and iron ore from WC India to China.

In the South Pacific, time charter levels for both handies and ultras have continued their rise over the last two weeks. The Baltic handy index route Southeast Asia to Japan—Singapore trip is quoted at around USD 11,000, up around USD 1,500 over the last two weeks. The ultra index route North China / Aussie round voyage has followed the trend with the handies and is trading around USD 14,225, up around USD 1,800 per day compared to two weeks ago.

Futures for Q2 2025 for both handies and supras are trading more in line with spot now at a premium of about 6-7%. Handies for Q3 2025 are trading at about 6% premium to the current spot levels while supras are selling up at around 8% to spot levels. Sentiment is that the market correction we have seen over the last month is about to slide sideways for a bit.

Subscribe below to receive the full report.

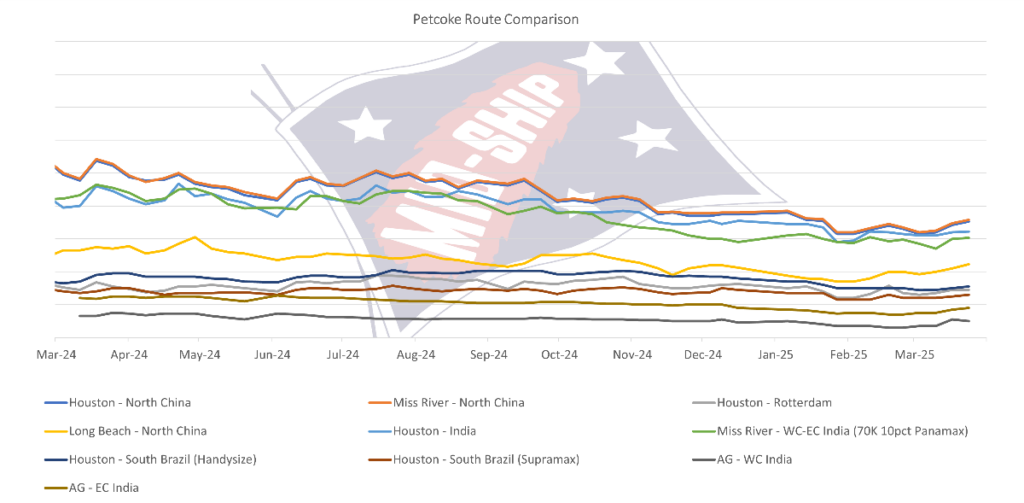

MID-SHIP Petcoke Report – Mar 24, 2025

March 24, 2025

Market overview:

The U.S. Trade Representative hearing, held Monday and Wednesday this week, is currently overshadowing market news. Due to limited business activity on U.S. trades, market participants are negotiating potential fees for charterers’ accounts, premium fixed rates, or cancellation clauses. It is estimated that the proposed fees could affect up to 75% of U.S. port calls in recent years, impacting forward pricing discussions for ocean freight. Our broker team is available to provide guidance on forward freight programs.

Despite the hearing, the market remains active across all segments and regions, with trading confined to a narrow range last week. Capes experienced a softer progression, Panamax and Supras showed mixed results, while Handies saw a moderate increase.

U.S. Trade is an exception, with significant volatility depending on the position and uncertainty surrounding the ongoing hearing complicating matters.

The market is anticipating the results of the Chinese government’s recent initiative to restore profitability to Chinese Steel Mills by compensating entities that close older blast furnaces to reduce production capacity.

Subscribe below to receive the full report.